International Payment Methods from OnlineCheckWriter.com – Powered by Zil Money: Simplifying Global Transactions

Remote work has officially gone global. By 2025, 50 million professionals will not be tied to a single office—or even a single country. Designers in France, developers in Eastern Europe, and consultants in India all collaborate daily with U.S. clients. But while the work itself moves smoothly across borders, payments have often lagged behind.

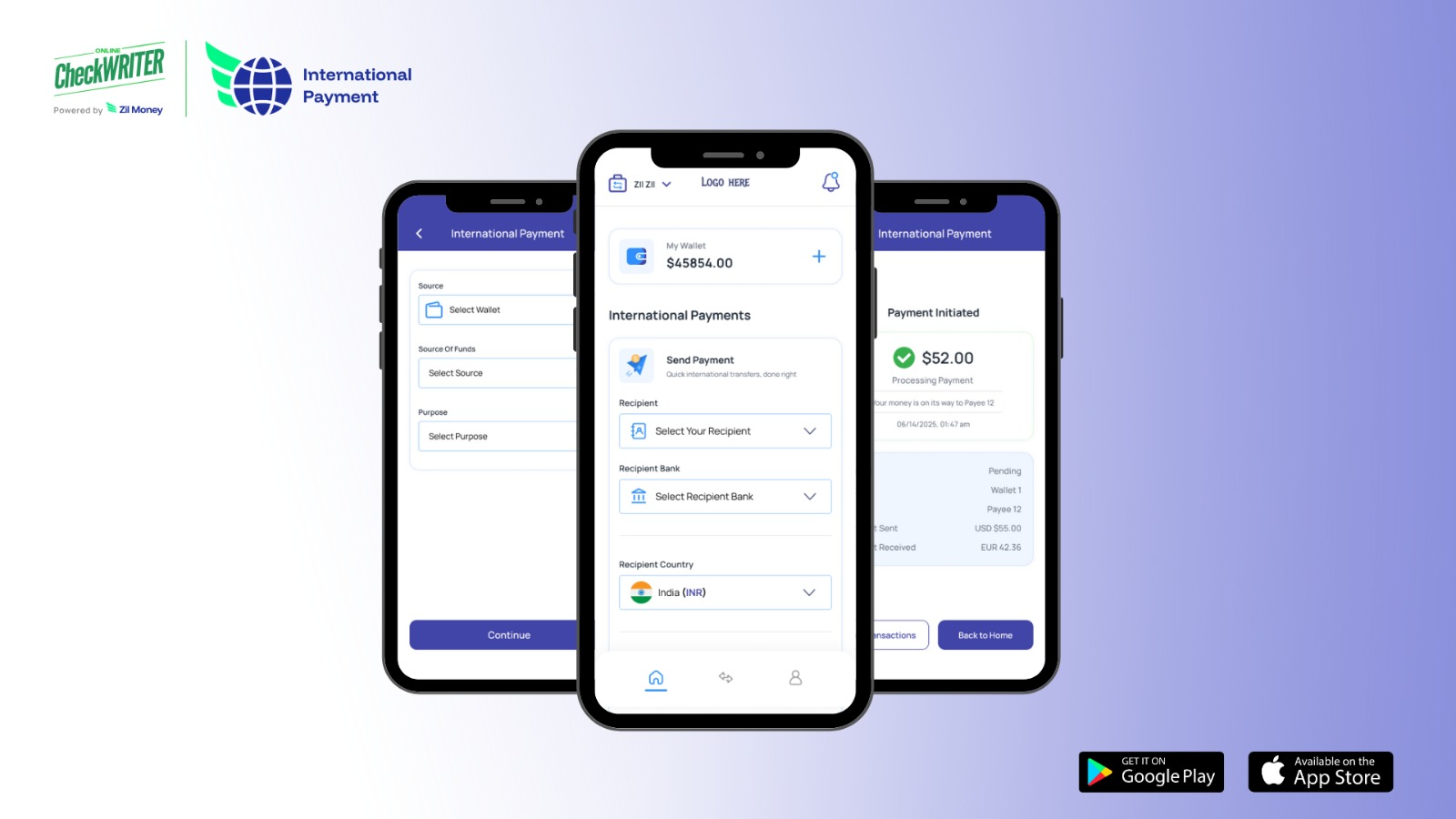

That’s changing. With new technology, regulatory shifts, and smarter platforms like OnlineCheckWriter.com – Powered by Zil Money, the international payment methods available today are finally catching up to the realities of global remote work. Here are the five biggest trends shaping how remote workers get paid from U.S. companies in 2025.

In the past, remote workers were often “under the radar,” bouncing between countries with little formal recognition. Today, many nations now offer remote worker visas, making it easier for professionals to legally live and work abroad.

But with legality comes responsibility: tax compliance, proof of income, and reliable payment records. Remote workers can’t afford inconsistent transfers or missing receipts. Payment methods that provide secure records, global accessibility, and compliance-friendly processing are becoming the default.

Platforms like OnlineCheckWriter.com – Powered by Zil Money are rising to meet this need by giving workers (and their clients) peace of mind: no matter where they live, payments are fast, documented, and transparent.

In 2025, talent moves as quickly as technology. Remote workers don’t just want to be paid—they want to be paid instantly. Waiting days for international wires feels outdated in an on-demand world.

Companies that pay faster are winning the loyalty war. In fact, 85% of U.S. Financial institutions have adopted the instant payment service. Instant payments are no longer a perk; they’re a competitive advantage for businesses trying to keep top talent.

With the platform, clients can transfer funds globally in minutes— through ACH—so workers get what they earned without delay.

Global inflation is eating into paychecks, and remote workers notice when 3–5% vanishes in “mystery fees.” By 2025, payment transparency will have become a make-or-break issue.

Workers demand to know:

· How much am I really receiving after fees?

· Are there hidden deductions on cross-border transfers?

· Why is my payment delayed by intermediaries I never chose?

The new standard is flat, upfront, no-surprise pricing. Platforms like OnlineCheckWriter.com – Powered by Zil Money cut through the noise by offering transparent, low-cost international payments—so remote workers keep more of what they earn.

The average remote worker in 2025 juggles many clients across multiple countries. Managing income through a wise, wallet, and wires quickly becomes overwhelming.

The trend is clear: workers want one hub to manage all payments—no matter the method, no matter the client. A single platform reduces errors, simplifies tracking, and makes tax season less of a nightmare.

That’s where the platform stands out. It consolidates ACH transfers, international wires, checks, and even wallet-based transactions—all under one roof. For remote workers, that means clarity instead of chaos.

With cyber threats escalating, remote workers are becoming more cautious about how they share financial details. Payment privacy is no longer optional; it’s expected.

Workers are asking:

· Will my bank details be safe?

· What if a client’s system is hacked?

· How do I avoid fraud or chargebacks?

In 2025, platforms that prioritize security and compliance are winning trust. The platform uses security, fraud protection, and compliance checks to ensure payments aren’t just fast—they’re safe.

Whether it’s remote workers or the companies they support, payments are just one part of the puzzle. In 2025, businesses want all-in-one platforms that go further. That’s where the platform stands out.

It’s not just an international payment service—it’s a complete B2B platform with 30+ tools. From accounts payable and receivable to virtual cards, check printing, payroll, and vendor payments, everything is managed in one place.

For remote workers, this means faster, reliable payments. For businesses, it means fewer providers, lower costs, and secure, streamlined operations.

For remote workers, these five trends add up to one truth: the way you get paid can define the way you work. Faster transfers mean fewer financial stressors. Transparent fees mean higher take-home income. Centralized dashboards and strong security mean peace of mind.

And for businesses hiring remote talent, keeping up with these trends isn’t optional—it’s essential for attracting and retaining the best workers in an increasingly competitive global marketplace.

International payments are no longer just about crossing borders. In 2025, they’re about speed, trust, transparency, and simplicity—values that matter most to remote workers worldwide.

The platform is built for this new reality, unifying , wire, credit card, check, and wallet payments in one platform. Explore how OnlineCheckWriter.com - Powered by Zil Money can simplify global payments for your team.

FAQs:

Can multiple clients pay through one system?

Yes. OnlineCheckWriter.com - Powered by Zil Money centralizes payments from different clients in one dashboard, making tracking and taxes easier.

Why is instant pay important in 2025?

With growing competition, faster payments help retain top freelancers. Many prefer clients who pay instantly.

How can remote workers avoid high transfer fees?

By using transparent services with OnlineCheckWriter.com - Powered by Zil Money, that cuts hidden charges. Flat, transparent pricing ensures workers keep more earnings.