OnlineCheckWriter.com – Powered by Zil Money is Busting old beliefs with the new mobile app

Fast international payments have become the lifeblood of today’s interconnected global economy. Whether paying overseas suppliers, reimbursing international teams, or closing deals in new markets, speed and reliability are paramount. Yet, many businesses remain anchored to outdated myths about cross-border transfers, preventing them from capitalizing on the new era of digital finance.

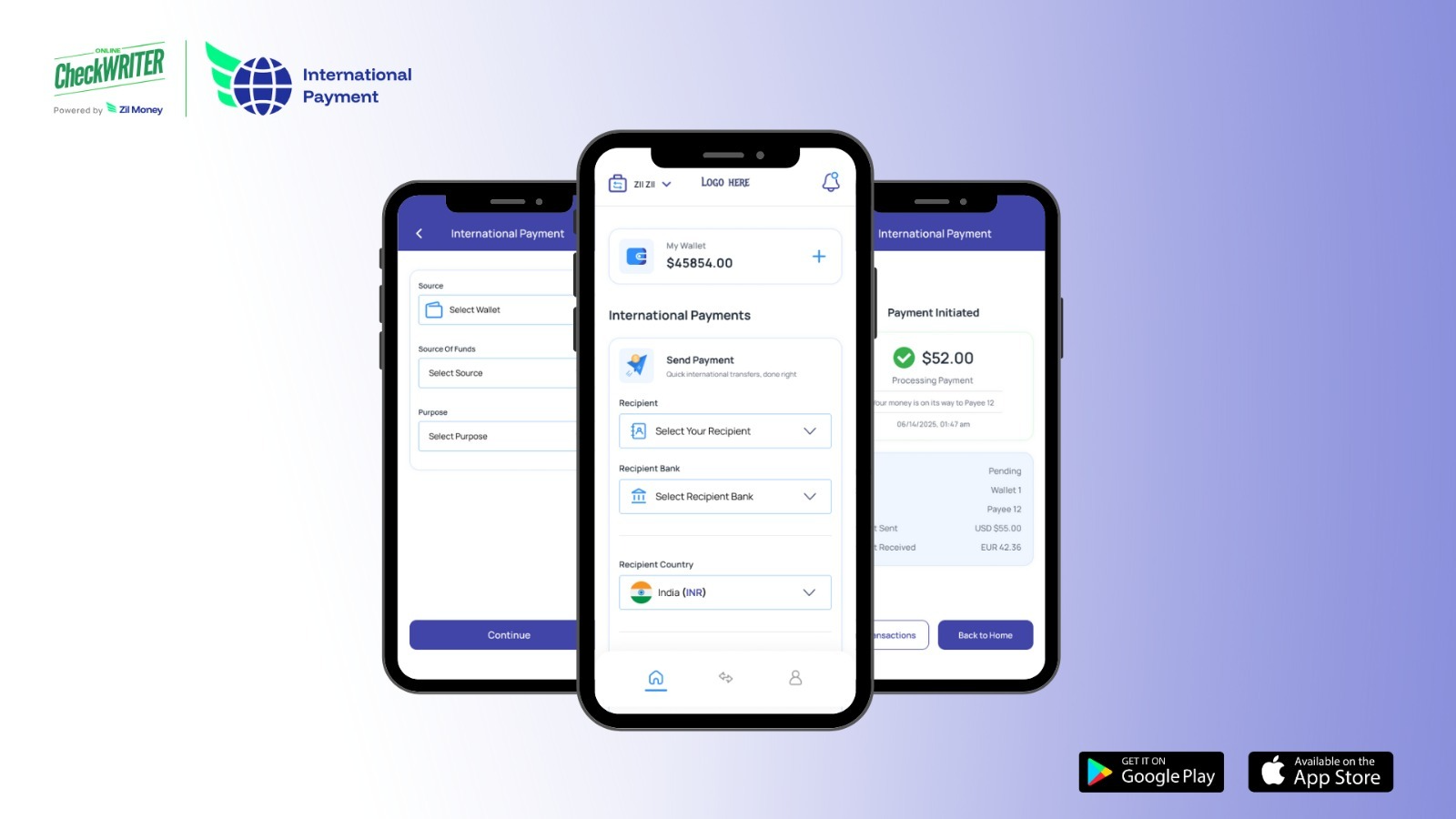

The newly launched international payments mobile app from OnlineCheckWriter.com – Powered by Zil Money is here to dismantle these myths and empower businesses with the tools they need to thrive globally.

Reality: The era of waiting 3–5 business days for funds to clear is officially over. With the adoption of real-time payment systems in over 70 countries, the new expectation is for payments to be settled in minutes, not days.

For manufacturers, this means no more production hold-ups while waiting for component payments to clear. For exporters, faster settlements ensure that shipments move without delay, strengthening supply chain resilience. The app’s optimized infrastructure is built for this new reality, delivering funds with the speed that modern business demands.

Reality: For too long, businesses have been forced to budget for ambiguous “surprise” deductions and unfavorable exchange rates that eat into their profits. The global payments industry, a massive $2.4 trillion market, has often been characterized by a lack of transparency.

This app changes the game by offering transparent, upfront pricing with no hidden costs. When combined with industry-leading exchange rates—often up to 4% better than those offered by traditional banking providers—the savings become substantial, allowing businesses to retain more of their hard-earned revenue.

Reality: The perception of cross-border payments as a bureaucratic nightmare is a relic of the past. The app simplifies the entire process into three straightforward steps: enter recipient details, select your funding source, and confirm the transfer.

There are no lengthy forms to fill out or complex approval chains to navigate. This simplicity provides finance teams and supply chain managers with the clarity and efficiency they need to stay on schedule and focus on strategic priorities rather than administrative tasks.

Reality: In an environment where 79% of organizations have been targets of payment fraud , it’s natural to assume that faster payments introduce greater risk. However, the opposite is true. Modern payment platforms are engineered with enterprise-grade security at their core.

The app integrates robust protection measures, including advanced encryption, real-time fraud monitoring, and mandatory two-factor authentication. With the annual global cost of cybercrime estimated at a staggering $10.5 trillion , these security features are not just important—they are essential. Every transaction leaves a clear digital audit trail, enhancing compliance and providing the peace of mind that comes with knowing your funds are secure.

Reality: The belief that only legacy banks can manage the complexities of B2B international payments is perhaps the most outdated myth of all. The app provides a comprehensive, end-to-end solution for B2B transactions without relying on a web of costly intermediaries.

From paying overseas suppliers in their local currency to reimbursing remote teams for expenses, transfers are executed directly and efficiently. This disintermediation not only cuts costs but also eliminates points of friction, giving businesses complete control and visibility over their global financial operations.

In a world where manufacturing supply chains, SaaS exports, and freelancer payouts span continents, cash flow delays create significant disruption. The cross-border e-commerce market is booming, and businesses that fail to adapt will be left behind.

Fast international payments do more than just move money—they keep operations fluid, strengthen partner relationships, and fuel growth initiatives. The mobile-first design of the OnlineCheckWriter.com – Powered by Zil Money app reflects the new reality: global business operates 24/7, and your payments infrastructure should too.

Stop letting outdated myths slow down your global operations. The new international payments mobile app from OnlineCheckWriter.com - Powered by Zil Money makes fast International transfers possible in just minutes.

Download now from the App Store or Google Play Store and take control of your cross-border payments.

Q1. How fast are the payments processed?

Payments are typically completed in minutes, keeping pace with the demands of global business.

Q2. Which countries are supported?

Transfers are available to a growing list of regions, including Germany, France, Estonia, India, the Philippines, Sweden, and the UK.

Q3. Is the app secure for large payments?

Yes. Every transaction is protected with state-of-the-art encryption, multi-factor authentication, and adherence to global compliance standards like GDPR and HIPAA.